Financial Education For Children

Today the economy is highly variable at all levels. It seems fair that at home some notions of economics are taught to children. It is what could be called financial education for children.

If viewed from a practical point of view, financial education for children would avoid many problems in the future. You should only look for the necessary tools to impart this knowledge in a fun way so that the child feels motivated with this activity.

Benefits of financial education for children

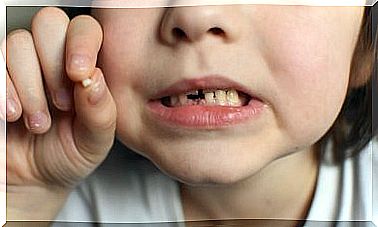

Financial education in children helps them lose their fear of money, it also allows them to better plan their savings and small expenses.

As the child saves and realizes the advantages that this action brings, he will be motivated to organize his expenses and plan better.

The role of parents in financial education

The first step is always the parents, assigning them an allowance, some reward for some work, among others; Along with the aforementioned, teach them the habit of saving.

The effort to earn the money must be the child’s, as parents have the duty to help, but always leaving the greatest share of responsibility to the infant.

It should be clear about which tasks or activities will be rewarded monetarily. For example, home duties, good behavior or school assignments are part of their duties, so they should not be rewarded with prizes of any kind.

Savings must be given the value it deserves. One of the most important functions of financial education for children is understanding what it really means to save. You must have a goal, so the motivation to save will be greater.

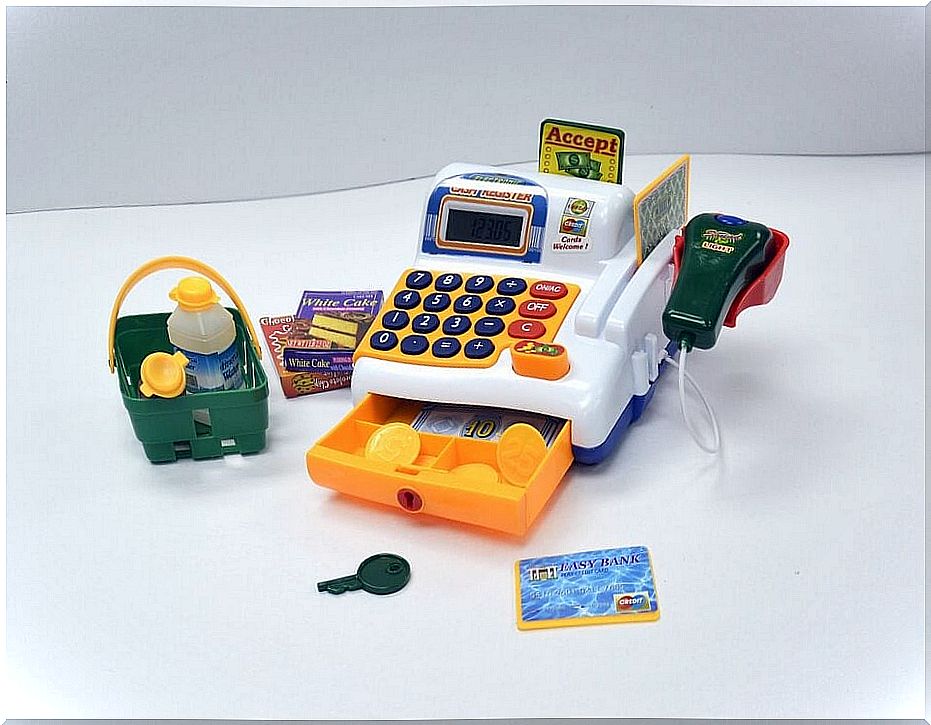

Financial education for children through play

One of the most effective methods of teaching is play. In the case of financial education for children, the game of Monopoly would be the most suitable.

In this game, the child begins to buy places, saves and reasons about what he needs to win. You plan strategies individually and have fun in the process.

It is always good to ask the boy questions about his actions taken or what he presumes he will do. For example, why do you think it would be okay to buy that house, or if you save money to buy something later. Simple questions to help you with future earnings.

Set goals and meet them

The fact of knowing what is going to spend money is very important. It is essential that the child have a clearer notion of the destination of their savings. Little ones always want toys. This wish can be used as a goal to promote savings.

The most used tool for this saving method is the piggy bank. Every time the child gets money, he deposits it in said element and when filling up he manages to materialize the desired purchases.

If it is the case that the money saved is not enough to buy what you want, you can talk with the little one and complete it, the idea with this is that the child feels the support of his parents in order to achieve the proposed goals.

It is really important to observe the thrifty behavior of the child and encourage them not to lose sight of the proposed goals and objectives. In this way, the child learns to save and make good decisions regarding money.

In many countries one of the most important aspects of financial education for children is raising awareness about their expenses and how to manage them; which in the future will be part of their day to day as adults.

It is always good to clarify to the child that everything has a cost, hence the importance of saving. It is easy to instill this idea through small expenses that the infant can and feels safe to bear.

Preparing children to be responsible consumers, teaching them the value of managing their money effectively and forming good habits in them, will help them to be adults with excellent financial responsibility.